Higher Rates Pressure Borrowers and Some Banks: Is Your Money Safe?

In March 2023, two of the largest bank failures in history alarmed savers who worried their own bank accounts could be at risk and investors who feared a wider financial crisis. To help restore confidence in the U.S. financial system, the federal government pledged to make all depositors whole and to support other banks that might face liquidity issues stemming from the rapid rise in interest rates.1

These events brought renewed attention to how banks operate and the risks they take to earn money on customer deposits, as well as the government’s role in regulating and supervising bank activities.

Interest rate risks remain

Between March 2022 and July 2023, the Federal Reserve raised the benchmark federal funds rate rapidly (from near 0% to a range of 5.25% to 5.5%) in a quest to bring down inflation.2 Banks earn money by investing customer deposits, often in relatively safe long-term Treasuries and other government-backed bonds. U.S. Treasury securities are backed by the full faith and credit of the U.S. government as to the timely payment of principal and interest. But as interest rates rose, bonds lost value on the secondary market. And in early 2023, this became a problem for banks that had to sell bond holdings before they matured to meet customer withdrawals.

With interest rates staying elevated longer than expected, there are concerns that a similar fate could befall regional banks with distressed commercial real estate loans in their portfolios. Already, many commercial lenders have set aside large reserves to help cover future losses from nonperforming assets (primarily office and retail buildings with high vacancy rates).3

Focus on the FDIC

The Federal Deposit Insurance Corporation (FDIC) is an independent agency backed by the full faith and credit of the U.S. government. FDIC insurance is intended to reassure depositors and offer protection in case an insured bank becomes insolvent, is liquidated, or experiences other financial difficulties. Most banks in the United States are insured by the FDIC, which protects deposits up to $250,000 (per person, bank, and account category). A joint account with two named owners qualifies for up to $500,000 of coverage. When a member bank fails, the FDIC issues payments to depositors (typically up to the limits provided by law) and takes over the administration of the bank’s assets and liabilities. Generally, the FDIC will try to arrange for a healthy bank to take over the deposits of a failed bank. If no bank assumes that role, the FDIC taps a fund that is financed by premiums paid by insured banks.

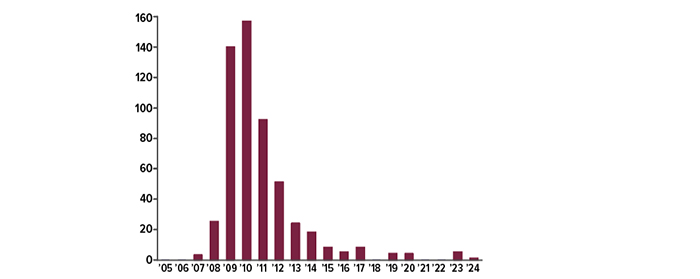

Number of bank failures

Source: Federal Deposit Insurance Corporation, 2024 (data through May)

Are your savings protected?

If you have multiple accounts at one bank, you might check to see who is listed as the owner(s) of each account, what category it falls into, and whether it overlaps with other categories that might affect the amount that’s covered. Ownership categories consist of individual accounts, joint accounts, retirement accounts, trust accounts, and business accounts, among others. You can’t increase your coverage by owning different product types (a checking account, savings account, or CDs, for example) within the same ownership category. A tool on the FDIC’s website (FDIC.gov) can help you estimate the total FDIC coverage on your deposit accounts. If your assets aren’t fully insured, you might consider shifting them to increase your coverage.

If you are married, for example, you could expand your total coverage up to $1 million at one bank by opening two separate individual accounts in addition to a joint account. If you have personal or business account balances that regularly exceed $250,000, you might consider dividing your holdings between multiple financial institutions — or possibly rethink your cash-management strategy altogether.

All investing involves risk, including the possible loss of principal.